At its most basic definition, a capitalization table, or “cap table” is a list of your companies securities. This list includes stock, warrants, convertible notes, and equity grants. While there is no standard format, a successful cap table should be able to tell you “who owns what”. Some cap tables can be more complex by adding formulas that model hypothetical transactions (e.g. public offerings, sales of the company, etc.) while others can be summary by nature ( e.g. grouping “founders” and “investors” in their own buckets).

Why do I need a cap table?

Cap tables are important because they show you who owns how much of your company. The type of capitalization table depends on your company’s stage and ownership structure. This can effect everything from future fundraising to who needs to sign off on company decisions.

How do I make a cap table?

As previously mentioned, there is no “right” way to make a capitalization table, it depends on the questions you are trying to answer. Here are a few key tips and tricks is to keep your table simple and organized. At a minimum, your cap table should have:

- Stockholder name as it appears on the security instrument

- Date of issuance

- Number of shares/units issued

- Concise and consistently-worded commentary

- Date of disposition if the security is no longer outstanding

Keeping it Current

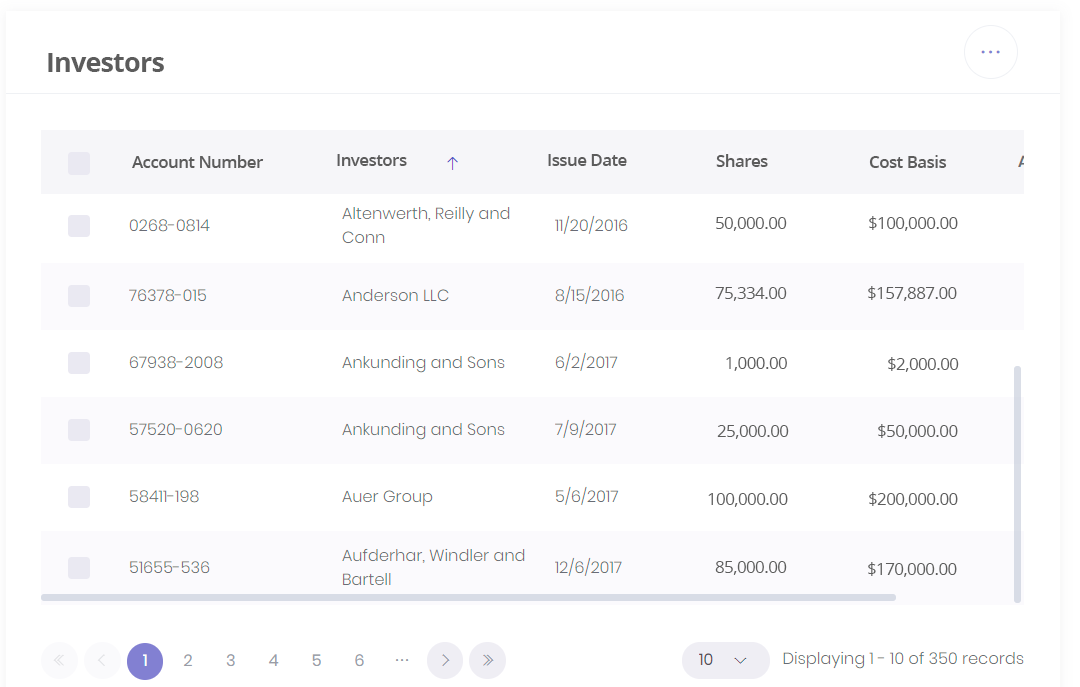

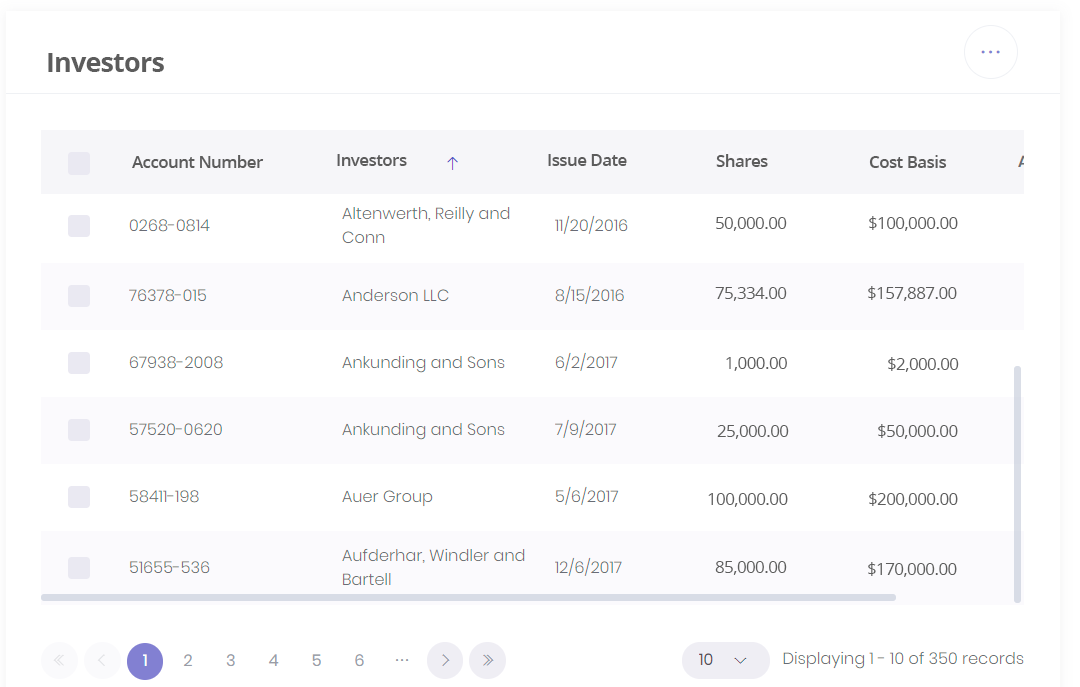

No matter how you design it, your cap table should always be updated. Use the tips mentioned above to keep yours current. Over the life of your company, you will have to send your cap table to many different groups, and it should be easily accessible by all parties. However, most companies that are using Excel for their cap table may be spending more time on rigorous excel formulas and manual updates than on actual analysis and investor relations. Companies can increase efficiency and reduce stress with affordable cap table management software. Cap table management software makes it easy for companies and their investors to make updates and edits quickly and accurately without having to use complicated formulas for control logs, ownership changes, cost basis tracking and AML compliance. Additionally, a good online platform, like Colonial Stock Transfer’s, should have these built-in features:

- Help track corporate governance to make the Board of Directors and Secretary’s job easier

- Compliance from a full support staff

- Reduced legal fees

- Automatic updates to reporting (no manual updates required)

- Ownership transfer service from full support staff

- Shared access with board members, officers and legal teams

- Investor and employee online access

- Employee plan administration

Contact Colonial to assist you in any questions you may have about your company’s cap table.