A transfer agent is a third-party financial institution that is appointed by a corporation, mutual fund, or company to act as the master shareholder recordkeeping provider and maintain the stockholder ledger and process any changes to it.

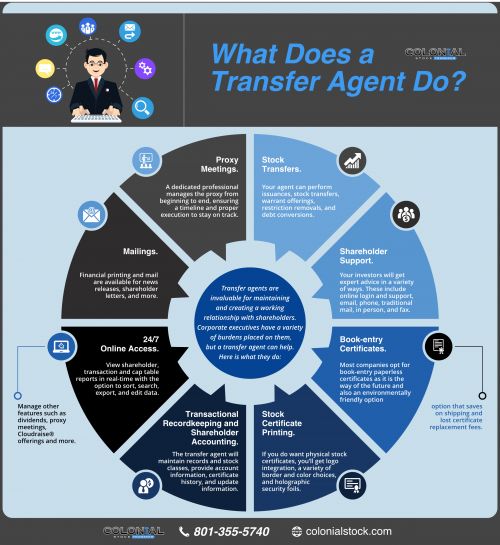

In addition to maintaining the master shareholder list, a transfer agent’s primary tasks include recording ownership transfers (also known as “stock transfers”), the issuance and cancellation of stock/security certificates, stock splits for the organization, general cap table management, and other shareholder account maintenance items.

Transfer Agent Duties

TAs may also perform the following functions:

- Dividend and shareholder payouts

- Corporate actions

- Lost stock certificate replacements

- Searching for lost shareholders

- Shareholder mailings

- Proxy voting and tabulation of annual meetings

TAs may not perform any of the following actions:

- Selling and purchasing of securities in the stock market

- Providing broker dealer solicitation and price quotes of securities

- Providing advice about which securities to buy

- Investment banking duties

Transfer Agent Vs. Stock Broker – What’s the Difference?

You might have heard of the term “transfer agent” and “stock broker” used interchangeably. However, it’s important to note these two are highly different roles. Since transfer agents act as a go-between for stockbrokers and registrar and transfer companies, they are responsible for some different tasks. For instance, transfer agents are responsible for registering stock ownership, transferring stocks from one person to another, and issuing shares of stock. On the other hand, stock brokers are responsible for helping investors buy and sell securities, including stocks and bonds. They have the expertise to analyze markets and advise clients on their best investment decisions.

| Transfer Agent | Stock Broker |

| Acts as a go-between for stockbrokers and registrar and transfer companies | Helps investors buy and sell securities, including stocks and bonds |

| Responsible for registering stock ownership | Provides expertise in analyzing markets and advising clients on investment decisions |

| Transfers stocks from one person to another | Facilitates buying and selling of securities on behalf of clients |

| Issues shares of stock | Executes trades on behalf of clients |

| Provides access to shareholder recordkeeping, transaction history, and shareholder correspondence | Offers market research, investment recommendations, and trading platforms |

| Primarily involved in administrative tasks related to stock ownership and transfers | Primarily involved in executing trades and providing investment advice |

| Focuses on maintaining accurate shareholder records | Focuses on maximizing returns and managing investment portfolios |

| May work closely with registrar and transfer companies | May work closely with investment banks, exchanges, and other financial institutions |

| Helps ensure compliance with securities regulations regarding stock ownership | Monitors market trends and adjusts investment strategies accordingly |

Being able to identify when you need a transfer agent instead of a stockbroker for your company will help you better understand the stock market and how it functions. Transfer agents provide access to shareholder recordkeeping, transaction history, shareholder correspondence, and more.

When Should I Seek Help From a Transfer Agent?

It’s important to understand when to seek help from a transfer agent for your business. Below are some key factors that can determine whether or not you need the services of a transfer agent:

- Are you looking to manage your cap table and track your investors better?

- Do you need to comply with SEC requirements for tracking accurate shareholder records (Public Companies, Reg A, Reg CF, etc.)?

- Do you need to outsource customer service for shareholders?

- Are you planning on taking your company public?

- Do you plan on actively trading shares with the public?

- Is your in-house compliance team big enough to comply with all IRS, UCC, and SEC rules?

- Do you need help managing your shareholder meeting and proxy voting?

- Do you plan on paying dividends?

- Do you plan on managing an employee stock option plan?

- Do you need DTC eligibility?

If any of these apply to your business, then it’s likely that utilizing a transfer agent is the best option.

Find the Transfer Agent for your Stock

In many cases, you can find the TA for a certain company or stock by searching the company on OTCmarkets.com and selecting the Company Info tab for that company. You may also want to visit the company’s investor relations’ website, call the company directly, or ask your broker. You can also search the company’s previous SEC filings at SEC EDGAR Company Search.

Trading Shares With the Public

It is required for public companies to utilize an SEC-registered transfer agent. Using a transfer agent will help, especially when issuing new securities or performing any type of complicated stock transfer. A publicly traded company can issue certificates, offer dividend distributions, and handle complex transactions – all of which require the help of a transfer agent. Using a transfer agent for these activities can ensure accuracy in recordkeeping and provide better customer service for shareholders.

As a refresher, publicly traded companies are those that issue securities and trade shares with the public. Some examples of publicly traded companies include:

- Apple

- Microsoft

- Amazon

Of course, not every business needs help from a transfer agent. For instance, if your company is a startup and has not yet issued securities, you may be too small for a transfer agent. Colonial Stock Transfer recommends having at least 10 shareholders before engaging its services. However, when it comes time to actively trade shares with the public, hiring a transfer agent can be invaluable in providing reliable customer service and accurate record keeping.

Managing Shareholder Records

Here is a list of the different types of records that transfer agents can help manage:

- Investor shares: Transfer agents track who owns how many shares of your company.

- Dividend Distributions: Transfer agents can help ensure that shareholders get their dividend payments on time.

- Share Certificates: If a shareholder requests a certificate (book-entry or physical), transfer agents provide it and keep records of who owns which certificates. In addition, if a certificate is lost or destroyed, transfer agents can help your shareholders replace these certificates as soon as possible.

- Stock Awards: Transfer agents can track stock options and stock awards for employee plans.

Shareholder Liason

In addition to these record-keeping duties, transfer agents act as an intermediary between the market, the issuer, and the shareholder. They are responsible for answering questions about transactions, handling transfers of ownership, and facilitating cash distributions when applicable. In addition, transfer agents wear many different hats and act as agents in a variety of capacities, including:

- Paying agents: Your transfer agent can pay out any interest, cash, stock dividends, or other distributions to your stock and bondholders.

- Proxy agent: Transfer agents can send out proxy materials such as proxy statements ahead of annual meetings.

- Exchange agent: Transfer agents can also be in charge of exchanging a company’s securities should there be a merger or corporate action.

- Tender agent: Transfer agents can tender shares in a tender offer during a buyout.

- Mailing agent: Keep your shareholders updated by having your transfer agent email and mail out your quarterly and annual reports.

How Can I Find a Reliable Transfer Agent?

It’s crucial that your transfer agent is licensed by the SEC, or Securities and Exchange Commission, so you know their services are reliable and regularly audited. Other qualities to look for in a reliable transfer agent include:

- 24/7 Availability: Fortunately, most transfer agents are now available online 24/7, so your shareholders can get the help they need whenever they have questions.

- Secure Infrastructure: Make sure your transfer agent has the necessary infrastructure to keep your data secure and protect against fraud.

- Customer Service: Look for a transfer agent that provides direct customer service. They should be available to answer questions and offer assistance with any issues that may arise – for you and your shareholders efficiently and carefully.

- Track Record: Last but not least, look for a transfer agent who does not have prior SEC complaints or regulatory issues. Research their track record and see if they have experience working with other companies in your industry.

The Bottom Line

Transfer agents play a critical role in helping companies provide high-quality investor relations to shareholders. Colonial Stock Transfer is here to help. Here is a list of the different types of transfer agent services we offer:

- NASDAQ/NYSE Transfer Agent Services

- OTC Transfer Agent Services

- Initial Public Offering Transfer Agent Services

- Private Company Transfer Agent Services

- Crowdfunding Transfer Agent Services

- Reg A+ Transfer Agent Services

Colonial Stock Transfer can help you with your transfer agent service needs. Learn more about our TA services.