A transfer agent is a company or financial institution that helps manage securities recordkeeping duties for private and public entities. Transfer agents perform many functions, including but not limited to: ensuring compliance with the Securities and Exchange Commission (SEC) following an initial public offering (IPO) or private placement, company merger/acquisitions, processing stock splits, administering shareholder meetings, issuing or cancelling stock certificates, and stock transfers. With these professional services, a transfer agent makes it easier for you to manage your investor cap table.

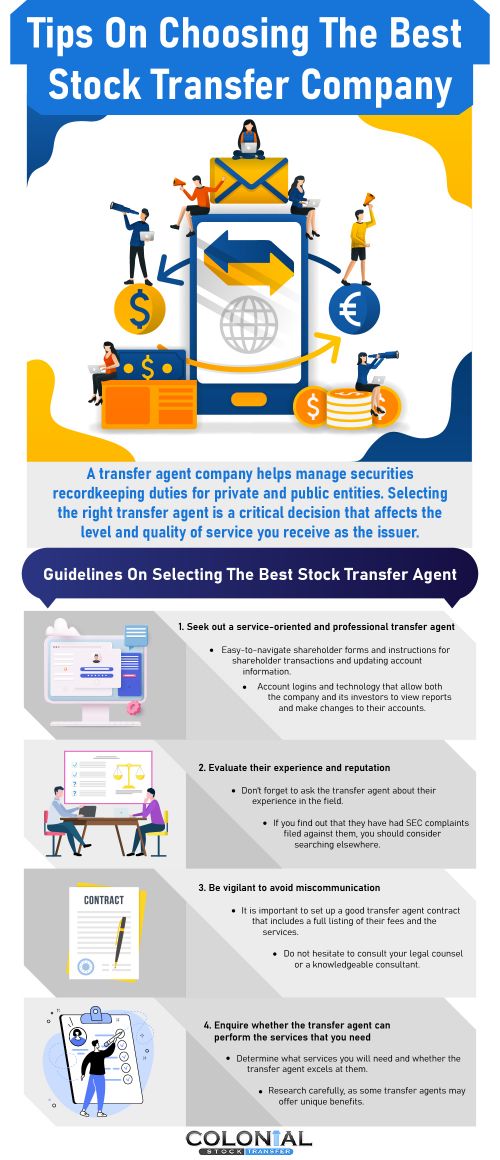

Selecting the right transfer agent for your company is a critical decision that not only affects the level and quality of service you receive as the issuer, but also the satisfaction of your investors and their perception of your company. Choosing the right one can help in a variety of ways, while selecting the wrong one may lead to numerous problems: it may cause state and federal compliance issues, problems with your investor relations campaign, securities clearing and settlement issues with DTC and brokers, corporate action discrepancies with FINRA, or problems with IPO and securities offering closings. We’ve witnessed all of these with clients transferring over to our firm.

Larger transfer agents often cater to the needs of huge public companies, and subsequently have advanced and unneeded services and higher fees. In contrast, smaller transfer agents cater to medium and small companies, and most often offer lower prices and personalized services. You should think about what is most important for you and your company when selecting a transfer agent.

1. Seek out quality service and professionalism in your transfer agent

Many transfer agents employ automated attendants; however, they can be a hassle to work with. Live representatives provide you with more personalized, immediate assistance for your questions and needs. It is vital to gauge the quality of these reps; a polite and professional staff will be the most beneficial for your company and investors.

You should also factor in responsivenss, knowledge and accuracy – how quickly do they respond and do they do it accurately. You don’t want to waste time and energy with a company that doesn’t know how to serve you on a timely basis with what you need.

Finally, the most important component of customer service is to have an agent that is professional, one that makes you look good to your investors, bankers, and funding network. These are your most important relationships, so you don’t want to go wrong here. A professional transfer agent should have most of these items:

- Easy-to-navigate shareholder forms and instructions for shareholder transactions and updating account information.

- Account logins that allow both the company and their investors to view reports and make changes to their account.

- Reports that are easy to read and download into exportable formats, including real time data.

- Professional statements and literature distributed to investors and to other company executives.

- A good website that includes information to help your investors understand the stock transfer process. Additionally, a blog may be helpful for your investors to read and learn from.

- Full services- an agent that can perform the various services you need. This will be discussed in detail later.

- Make sure they know what they are talking about – SEC registered transfer agents are required to be audited by an external CPA firm annually and by the SEC at any time. This doesn’t guarantee anything but is important.

When deciding on transfer agents, opt for the one with a better service team. It is essential to have a trusting, reliable transfer agent that can provide consistent and high-quality customer service.

2. Evaluate their experience and reputation

Don’t forget to ask the transfer agent about their experience in the field. How long have they been in business? Are they registered with the SEC? If you find out that they have had SEC complaints filed against them or may have engaged in unethical business practices, you should strongly consider looking elsewhere. In order to determine this and the quality of their reputation, you should submit a request for references as well.

3. Be vigilant to avoid miscommunication

It is important to setup a good transfer agent contract that includes a full listing of their fees and the services you expect from them. Do they have a term length specified in the contract or large termination fees? We’ve had several clients that have tried to switch from agents that had termination fees in the tens of thousands of dollars because the transfer agents left the termination fees out of the agreement. Be mindful of the contract terms before committing to a transfer agent and do not hesitate to consult your legal counsel or a knowledgable consultant.

It is important to have good communication with your transfer agent. Just think if your transfer agent misallocated shares on a reverse stock split and awarded certain shareholders with incorrect amounts. We had a client that this happened to – we spent a lot of time correcting the mistakes with FINRA and DTC.

4. Ask the right questions

Ask tough questions. Remember, you are looking for the right transfer agent for you. Consider the following:

- Is the transfer agent registered with the SEC? If your company is public, this is a must have. If your company is private, it is a requirement in most scenarios – we advise that you ask your securities counsel. We recommend private companies with at least 10 investors engage a transfer agent.

- Has the agent had any complaints filed against them? If the transfer agent or its officers have had an SEC complaint in the past, this may be worth investigating in detail. Of course, there are two sides to every story so do your research and do what you feel is most comfortable for you and the parties involved. Keep in mind that inviting regulatory issues into your business and personal life is not ideal.

- How long have they been in business? From my experience, the longer they’ve been in business, the more experience and knowledge they will have to navigate through your most difficult and important transactions.

- What do their customers say about them? Are there any customers that they have lost and why?

- Do they offer the services you need? If so, to what depth? And, how good are they at doing them?

- Ask about the cost of their services. How do they compare with the industry standard? If you receive a flat-fee bundle, be sure to know exactly what services are covered and how they affects your needs.

There may be other relevant questions to you and your business only – asking the right questions will help you decide on a transfer agent. Be detail-oriented, you will be happy later.

5. Know that the transfer agent can perform the services that you need

What services does the agent provide? Are they a crowdfunding transfer agent? Alternatively, are they good at managing employee plans or shareholder proxy meetings? Perhaps you need help with becoming DTC eligible, or completing DWAC/DRS transactions for important investors; or, maybe you need help issuing dividends to your shareholders. In addition, some transfer agents offer other services such as newswire distribution and EDGAR filings. Depending on the needs of your company, you may not need every one of these services. Determine what services you will need and whether the agent excels in them. You may want a unique transfer agent that specializes in privately company services. Research carefully, as some transfer agents may offer unique benefits.

6. Specify your objectives to the transfer agent through a 5 question survey or Request For Proposal

It is important to understand the capabilities of the transfer agent by asking the right questions as presented earlier. In order to do this, we recommend inquiring different ways based on the volume and number of investors within company:

- For Fortune 500 or companies of similar size, I recommend creating an RFP that focuses on your most important questions. In short, an RFP is a request for proposal to a company that details the primary services you require from them. Concise and thoughtful RFPs are key to finding the right transfer agent for your company. Its not about the number of questions but the quality. Transfer agents receive numerous RFPs so it is vital to be concise yet informative.

- For mid to small-cap or private companies, I recommend creating a 5 question survey with your most important needs being addressed. This may include questions about special services your require (annual meeting, dividends, ESSP, etc.), pricing, exchanges, DTC, corporate actions, experience, and references. The point here is to be concise but effective.

Using these methods will help you further organize and prioritize your goals and not only find an appropriate transfer agent, but first identify the qualities you desire in your future transfer agent, based on the needs of your company.

7. Is the agent on top of industry and regulatory changes?

It is critical to have an agent who knows when changes in the industry and regulations are happening, one that will inform and help prepare you for compliance. An agent that does not notify you in advance or does not comply with regulations is putting you at risk. For example, under the JOBs Act, Regulation A was changed by the Securities and Exchange Commission (SEC) on March 25, 2015 to make it easier for companies to raise money up to $50 million from unaccredited investors under Tier 2 of the amended rules, also known as Regulation A+. A transfer agent who does not keep up with changes such as these may deprive their clients of a great opportunity to significantly grow and invest in new technologies. Similarly, rule changes such as the IRS cost basis reporting and DTC cusip eligibility fee are just as important; failure to address these rule changes could result in compliance issues, which puts your company at risk. Thus, an agent that stays atuned to the latest regulatory changes will be important to make your job easier and stress free.

8. Focus on your needs and goals

Find an agent that will help you meet your needs and achieve your goals. For example, do you want an agent who caters to a certain type of client (ie, Fortune 500), or one that focuses on providing good service to smaller clients, or both? Are you a private company, looking to go public? If so, this requires services that may not be offered by every transfer agent. Weighing the benefits and drawbacks of each transfer agent may be critical to the success of your business. For example, some companies may emphasize the efficiency of their software, while others may pride themselves on their longevity or personalized service. What characteristics of a transfer agency will optimally help your company succeed? The answer to these questions will help you choose the right transfer agent that can assist you in accomplishing your personal goals.

Keep these tips in mind when you’re looking for a transfer agent to suit your needs. For more information about hiring a transfer agent, please contact Colonial Stock Transfer sales department at 877-285-8605, or complete this contact form.