On Nov. 2, 2020, the Securities and Exchange Commission (SEC) adopted amendments to the exempt offering framework under the Securities Act of 1933. The rules will benefit the investors, emerging companies, and more seasoned issuers by:

- Simplifying the multilayer exempt offering framework.

- Promoting capital formation

- Expanding investment opportunities

- Preserving investor protections

Background:

All securities offerings must be either registered with the SEC or qualify for an exemption from registration. While larger companies follow the registration process, smaller emerging businesses rely on the exempt-offering framework for raising capital. With every legislative change and commission rule amendment, the framework has become more complex, making it difficult and confusing for small businesses. Chairman Jay Clayton remarked, “While each component in this patchwork system makes some sense in isolation, collectively, there is substantial room for improvement.

Amendments:

Integration Framework: The amended rules provide clarity on the issuers’ ability to shift from one exemption to another. The new integration framework provides a general principle that defines whether the offering complies with the registration or is exempt. Following are four non-exclusive safe harbors from integration:

- Any offering made more than 30 calendar days before or after any other offering will not be integrated with such other offering(s); provided that:

- For offering prohibiting general solicitation following offering allowing general solicitation by 30 calendar days or more: The purchaser neither has a substantive relationship nor is involved through general solicitation by the issuer (or any person acting on the issuer’s behalf) before the commencement of the exempt offering prohibiting general solicitation. General Solicitation refers to marketing an offering.

- Offering through Rule 701, under an employee benefit plan, or Regulation S will not be integrated

- A registered security will not be integrated if it is offered after:

- A terminated or completed offering prohibiting general solicitation,

- A terminated or completed offering permitting solicitation made only to qualified institutional buyers and institutional accredited investors, or

- When the offering allowing general solicitation, is terminated or completed more than 30 calendar days before the commencement of the registered offering

- Offers and sales made in reliance on an exemption permitting general solicitation, will not be integrated if made after any terminated or completed offering.

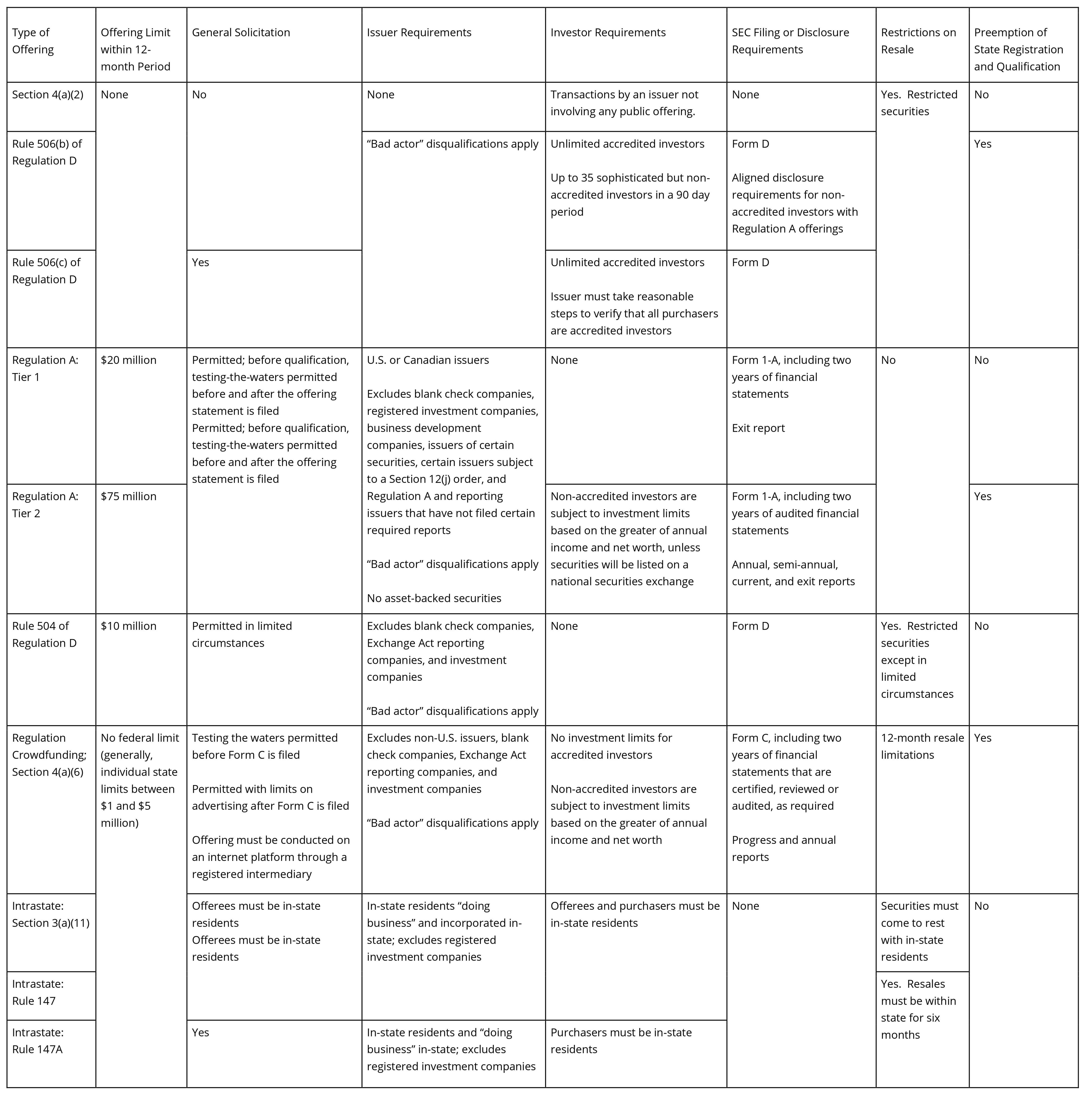

Increasing the offering limits for Regulation A, Regulation Crowdfunding, Rule 504 offerings:

- Regulation A (Reg A):

- Maximum offering amount raised from $50 million to $75 million in Tier 2

- Maximum offering amount increased from $15 million to $22.5 million under Tier 2 secondary sales

- Regulation Crowdfunding (Reg CF):

- Maximum offering amount increased from $1.07 million to $5 million;

- No investment limits for accredited investors:

- Considering greater of annual income or net worth for calculating investment limits of non-accredited investors

- 18 months extension on the existing temporary relief, which itself provides an exemption from specific financial statement review for issuers offering $250,000 or less of securities in reliance on the exemption within 12 months.

- Rule 504 of Regulation D (Reg D):

- Maximum offering amount raised from $5 million to $10 million

Clear and consistent rules on general solicitation including “test-the-waters” and “demo day” activities:

- Issuers are allowed generic solicitation to “test-the-waters” before determining the exempt offering it will use for the sale of the securities;

- Regulation Crowdfunding issuers are permitted to use “test-the-waters” before filing an offering document with the SEC

- Specific “demo day” communications will not be considered a general solicitation or general advertising.

Reconciling certain disclosure and eligibility requirements:

- Investors can use special purpose vehicles (SPV) for investing in Reg CF.

- Eligibility restrictions on issuers delinquent in their reporting obligations for offerings using Reg A

Attuning “bad actor” disqualification provisions in Reg D, Reg A, and Reg CF

The financial information provided to non-accredited investors in Rule 506(b) private placements must align with the financial information provided to investors in Reg A.

Including a new item in the non-exclusive list of verification methods in Rule 506(c)

Simplifying Reg A offerings and establishing consistency between Reg A and registered offerings

The amendments will be effective 60 days after publication in the Federal Register. Extension of the temporary Regulation Crowdfunding provisions will be effective immediately upon publication in the Federal Register. For details, click here

Summarized overview of exempt offering framework:

At Colonial Stock Transfer, we provide crowdfunding transfer agent services for Reg CF, Reg A+, 506C offerings through the use of an innovative medium. Contact us toll-free at (877) 285-8605 or click here to get more information