Through Rule 144, any small business owner, or investor, can sell their restricted stock, or securities, on the public stock market without registering them with the SEC. This legislation is important because it gives the investors and shareholders who have these securities the opportunity to resell their restricted securities themselves. In most cases, this can be more valuable than just holding onto the securities indefinitely.

What Is Rule 144?

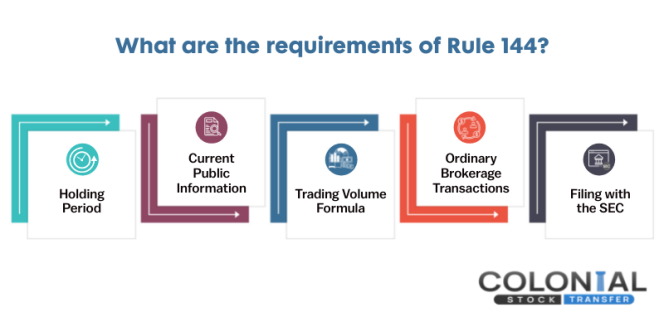

Rule 144 is a set of SEC guidelines dictating how restricted or unregistered securities can be sold or resold by all types of sellers. We will review the five parts that need to be satisfied below.

What is the difference between Restricted and Free-trading Securities?

Restricted securities are securities acquired through employee benefits packages, compensation for services, start-up capital, or a merger and acquisitions (M&A) transaction. Free Traded Securities can be found in the public stock marketplace, while restricted stock cannot.

What are the requirements of Rule 144?

1. Holding Period. When buying or selling any restricted securities in the marketplace, you are required to hold them for a certain period. If the issuer is a “reporting company,” meaning they adhere to the Securities Exchange Act of 1934, you must hold them for six months. If the issuer is not a “reporting company,” then you must hold them for at least one year.

The holding period begins when the restricted securities are bought and fully paid for.

2. Current Public Information. For reporting companies, SEC Rule 144 requires them to comply with the periodic reporting rules of the Securities Exchange Act of 1934 for each transaction. Non-reporting companies are required to have critical company information, such as the nature of their business, the directors, and its financial statements publicly available to shareholders. Also, any company that is currently, or has ever been, a shell company cannot qualify as a Non-reporting company.

3. Trading Volume Formula. If you are an affiliate, SEC Rule 144 says that the securities you sell during any three months cannot exceed 1% of the outstanding shares of the same class being sold. Also, if the class is on a stock exchange, affiliates cannot sell greater than 1% of the average reported weekly trading volume during the four weeks preceding the filing of Form 144.

4. Ordinary Brokerage Transactions. Another affiliate rule is that the sales must be handled as routine trading transactions. This means they can only have one commission and cannot solicit orders to buy the securities, or remove the restrictions on a non-selling transaction.

5. Filing with the SEC. Affiliates must file Form 144 with the SEC if more than 5,000 shares of restricted stock are being sold or the aggregate amount is greater than $50,000 in three months.

Navigating Stock Restrictions: Rule 144

If someone has not been an affiliate for at least 90 days or isn’t an affiliate of the company issuing the securities, they can sell their securities if the company is a “reporting company” and they have held the securities for more than six months. If you are planning on removing the restriction to become a free trading stock, even when you meet the conditions of Rule 144, you have to get the legend removed from the certificate by a transfer agent. The transfer agent cannot remove the legend without an opinion letter in most cases. Sometimes this process can require you to work with an attorney who specializes in securities law.

Whether you want to know the rules for purchasing the restricted security fully or if you’re trying to sell your restricted security in a public marketplace, Colonial Stock Transfer, as a transfer agent, will help organize the information and guide you past typical pitfalls and oversight.

Rule 144, like most rules regarding restricted securities, can be very overwhelming and confusing. With the right guidance and experience using this rule, any shareholder can easily remove their restriction through Rule 144 and trade it in the public markets.