Before diving into the different types of crowdfunding, it is important to explore what is meant by the term “equity crowdfunding.” Instead of a company raising debt capital, companies will raise money by offering money in exchange for shares of the company, also known as equity. This is a common method of raising capital for startup companies and companies at early stages of growth.

→ SKIP TO EQUITY CROWDFUNDING COMPARISON TABLE

In equity crowdfunding, the company will offer securities to a number of investors in exchange for those investors providing capital that the company can use to purchase inventory, run marketing campaigns, or hire more staff. There are other incentives that companies might offer with the equity crowdfunding campaign as well, such as convertible notes and dividends.

Regulations for Running an Equity Crowdfunding Campaign

When compared to other methods of raising money, an equity crowdfunding campaign is still relatively new. As a result, many countries, including the United States, are still in the early phases of passing regulations, with the biggest one being the Jumpstart Our Business Act (JOBS Act), passed in 2012. The law was also revised in 2016, making it easier for people to invest in private companies. It is critical for businesses to be aware of rules and regulations surrounding equity crowdfunding, with some of the biggest regulations being:

- Companies that want to run an equity crowdfunding campaign need to register on a funding portal approved by the SEC.

- Businesses can only accept a limited amount of funds, depending on the type of fundraising they conduct.

- Businesses are required to publicly disclose information related to the amount of funding they receive.

- Companies that want to raise money in the United States need to be registered in the United States.

There are additional regulations that companies might need to follow depending on the type of campaign they conduct.

Regulation CF: Regulation Crowdfunding

Under Reg CF, businesses issuing shares are allowed to raise up to $5 million annually. This is a change that was made in 2020, making it easier for businesses to raise larger amounts of money. Investors must be at least 18 years of age, and companies can raise money online.

If companies are trying to raise more than $1.07 million, businesses are required to have an independent CPA audit the last two years of financial statements (or all financial statements since the start of the business, if the business is less than two years old).

Businesses are also required to follow all due diligence requirements, and that is where working with an SEC-registered broker-dealer can be beneficial.

Individual investors are allowed to invest up to $2,200 per year in each round of regulation crowdfunding. Accredited investors are able to invest more than this, but the maximum amount they can invest is dependent on their declared income and overall net worth. The cap for everyone is $107,000 per year, but it might be lower for those who make less than $1.07 million per year.

Regulation A+

Another type of equity crowdfunding is called Regulation A+. Reg A+ allows companies to raise up to $75 million per year from the general public. When compared to companies that are publicly traded, Reg A+ equity crowdfunding generally moves faster.

To conduct a Reg A+ equity crowdfunding campaign, companies are required to hire a securities attorney. Businesses need an attorney to file Form 1-A for SEC approval. It can take a few months to get approved, and companies will be required to undergo an audit that includes at least the last two years of financial statements.

In addition, if companies have not sold securities using Reg A+ before, businesses will be required to submit an offering statement. There are multiple tiers of offerings available, and they vary depending on the amount of money the company wants to raise. The offering statement will be reviewed by the SEC before the company is approved, and the statement is filed publicly on the EDGAR database.

After the SEC has approved the application, the company will be allowed to sell securities to the general public, offering shares of the company in exchange.

Regulation D 506C

Finally, Regulation D 506 C is an attractive option for entrepreneurs who are looking for ways to raise an unlimited amount of money. While it is nice to raise as much money as is needed, companies are only allowed to raise this money through accredited investors. The company issuing shares is required to verify that anyone investing in the company meets the definition of an accredited investor. All due diligence conditions have to be met, which is where working with an SEC-registered broker-dealer can be helpful.

Furthermore, companies can raise private funds using securities without having to register those actual securities with the SEC. Furthermore, there are not as many filing requirements; however, entrepreneurs will be required to fill out other forms, such as a D form, to show that they meet the regulations to run this type of campaign. This form will ask for a variety of demographic information, including the name of the company, the names of all officers on the company’s board, and the compensation arrangement for the securities sold. There might be some legal prerequisites to meet as well, which is another reason why working with a financial or legal professional is beneficial.

Choosing Reg A, Reg D, or Reg CF

Ultimately, equity crowdfunding campaigns come in many shapes and forms. It is incumbent on businesses to evaluate the benefits and drawbacks of each option before making a decision. Businesses must consider their needs and goals to make sure they get the money they need while protecting the company as much as possible. When compared to a traditional IPO, equity crowdfunding may have a lower barrier to entry and provides a way for the business to raise capital without taking on any extra debt.

If you have questions about how to run an effective equity crowdfunding campaign, you should speak to a licensed broker-dealer today.

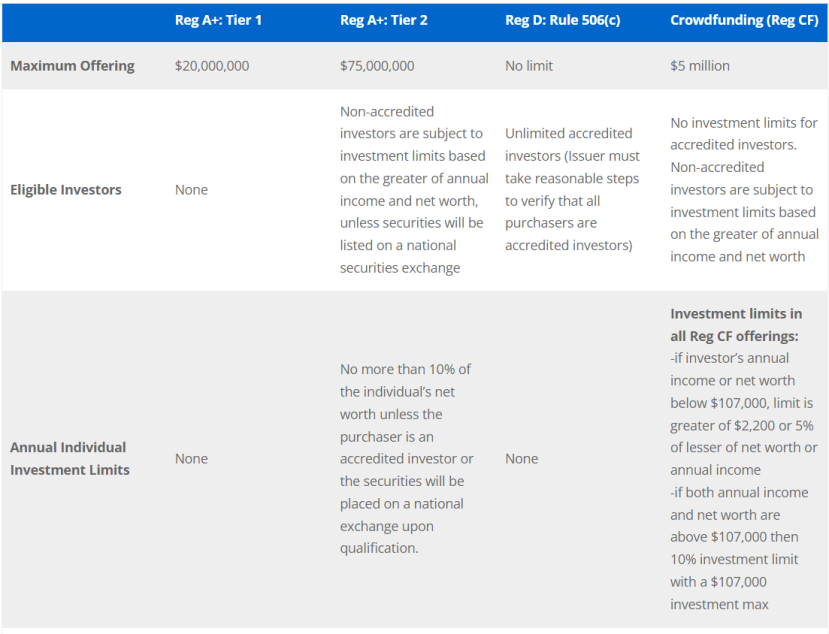

We developed a comprehensive Equity Crowdfunding Chart Comparison below for all crowdfunding requirements that includes Reg A+ (Tier 1 and Tier 2), Reg D 506 C, and Reg CF. Our chart creates an easy-to-read visual representation of all the different requirements, so you can pick which form of crowdfunding works best for you. Equity Crowdfunding Requirements for each type can be confusing, so our chart allows you to easily see how the requirements vary.

| Reg A+: Tier 1 | Reg A+: Tier 2 | Reg D: Rule 506(c) | Crowdfunding (Reg CF) | |

| Maximum Offering | $20,000,000 | $75,000,000 | No limit | $5 million |

| Eligible Investors | None | Non-accredited investors are subject to investment limits based on the greater of annual income and net worth, unless securities will be listed on a national securities exchange | Unlimited accredited investors (Issuer must take reasonable steps to verify that all purchasers are accredited investors) | No investment limits for accredited investors. Non-accredited investors are subject to investment limits based on the greater of annual income and net worth |

| Annual Individual Investment Limits | None | No more than 10% of the individual’s net worth unless the purchaser is an accredited investor or the securities will be placed on a national exchange upon qualification. | None | Investment limits in all Reg CF offerings: -if investor’s annual income or net worth below $107,000, limit is greater of $2,200 or 5% of lesser of net worth or annual income -if both annual income and net worth are above $107,000 then 10% investment limit with a $107,000 investment max |

| Investor Verification | None | Self-certification required for investment limits | Must take reasonable steps to ‘verify’ status | Self-certification required for investment limits |

| Solicitation | Permitted; before qualification, testing-the-waters permitted before and after the offering statement is filed | Permitted; before qualification, testing-the-waters permitted before and after the offering statement is filed | Yes | Marketed over internet, with primary solicitation and disclosure occurring on ‘funding portal’ |

| Pre-filing | Issuers are allowed to “test the waters” or solicit interest either before or after filing the offering statement | Issuers are allowed to “test the waters” or solicit interest either before or after filing the offering statement | No pre-filing requirements except certain state filings | Pre-filing with SEC required before any offers are made |

| SEC Filings | Must file Form 1-A | Must file Form 1-A | Must file Form D | Must file Form C |

| State Filings (see our Blue Sky Filings Services) | State registration must be filed to all 50 states. | State registration is preempted except in these circumstances: “Issuer-Dealer” Registration is required for issuers involved in selling the securities themselves in AZ, FL, ND, NE, NY, TX. Agent Registration is required for any officer or director undertaking selling efforts in AL, NV, NJ, WA. |

State registration is preempted but issuers must file state notices to all 50 states. | State registration is preempted |

| Financial Disclosure | Two years of financial statements and Exit report | Two years of audited financial statements, Annual, semi-annual, current, and exit reports | None | Two years of financial statements that are certified, reviewed or audited, as required. Progress and annual reports |

| Ongoing SEC Filings | None, except Exit report | Annual, semi-annual and current reports are required | None, unless the offering remains open after 1 year | The same information that is provided in the initial filing also required to be filed yearly |

| Exemption from Section 12(g) Reporting | Total assets greater than $10 million and a class of equity securities held by 2,000 or more persons, or 500 or more persons who are not accredited investors | Must meet these criteria: 1. Engage SEC registered transfer agent. 2. Remains subject to a Tier 2 reporting obligation. 3. Is current in its annual and semiannual reporting at fiscal year-end. 4. Has a public float of less than $75 million, or, in the absence of a public float, had annual revenues of less than $50 million. |

Total assets greater than $10 million and a class of equity securities held by 2,000 or more persons, or 500 or more persons who are not accredited investors | Total assets greater than $10 million and a class of equity securities held by 2,000 or more persons, or 500 or more persons who are not accredited investors |

| Resale Restrictions | No | No | Yes. Restricted securities | 12-month resale limitations |

| Eligible for Broker Quotes | No | Yes – NYSE, NASDAQ, OTCQX, OTCQB | Securities ‘restricted’, cannot be freely resold | Limited resales allowed for one year |

| Shareholder Limits | None, in most instances | None, in most instances | 2,000 accredited investors | Unlimited |

| Intermediary | None are required | None are required | None are required | Funding portal or Broker-dealer required |

| Liabilities | Standard 12(a)(2) Liability | Standard 12(a)(2) Liability | Standard 12(a)(2) Liability | The burden of proof for ‘diligence defense’ is placed on the issuer |

The Pros and Cons of Equity Crowdfunding

It is also helpful to explore the pros and cons of equity crowdfunding. Some of the biggest benefits of equity crowdfunding include:

- Capital Is Easier To Access: In general, equity crowdfunding provides easier access to capital. Companies can conduct these campaigns online, which makes it easier for investors to learn more about the company before they decide to invest.

- Reduced Pressure on the Management Team: It is true that in equity crowdfunding, the company may have to surrender some shares; however, with a large number of investors holding relatively few shares, the power concentration of the management team is less likely to be diluted, particularly when compared to other options, such as venture capital.

- Better Returns for Investors: While startup companies are always risky, there is a chance that the company could become very profitable in the future, providing an attractive investment opportunity for investors.

- No Debt: Of course, one of the biggest benefits of equity crowdfunding is that the company is not going to take on any additional debt. Because the company is providing equity in exchange for capital, the business will be under no obligation to pay the money back in the future.

- No Application Process: When companies want to take out a loan from a traditional lender, they need to go through a lengthy application process, and they might not be approved in the end. There is no such application process when taking the route of equity crowdfunding.

Clearly, there are a number of major benefits that come with running an equity crowdfunding campaign. On the other hand, there are a few drawbacks as well. They include:

- No Guarantee of Funding: There is no guarantee that the business is going to raise the funds it needs. It will only get the money if the investment opportunity is deemed attractive by investors.

- Surrender Equity and Profits: To raise capital, companies will have to give up a portion of equity and business profits. This means that the founding partners might not take home as much of the profits stemming from future purchases of its products and services, as other investors will be entitled to those profits as well.

- Time-Consuming: Running an equity crowdfunding offering can be time-consuming. There are multiple ways to run an equity crowdfunding campaign, and businesses need to think about which path is best for their needs. Some platforms might streamline the process, but they could take a commission on the money raised as well.

- Traditional Investors Might Hesitate: Traditional investors might hesitate to invest in a business that runs an equity crowdfunding. Because it is non-traditional, some investors might be worried about the inability to sell shares without taking a financial loss.

It is critical for every business to evaluate the benefits and drawbacks of running an equity crowdfunding campaign before they move forward. That means taking a closer look at the regulations as well.

Colonial Stock Transfer is available to help with any of your transfer agent and crowdfunding needs. Please contact us to learn more.

Updated December 6, 2022