As the SEC continues to focus on how public companies use non-GAAP measures, they have issued updated Compliance & Disclosure Interpretations (C&DIs) regarding their usage. Non-GAAP financial metrics are numeric representations of performance, finances, or cash flows that don’t follow Generally Accepted Accounting Principles (GAAP). This new guidance makes clear what is deemed a misleading measure and provides more insight into the prominence of such measures in filings with the SEC.

Key Takeaways

- SEC updates Compliance & Disclosure Interpretations (C&DIs) on non-GAAP measures for transparency and accuracy in financial reporting.

- The new guidance addresses potentially misleading non-GAAP measures, prominence in SEC filings, and proper labeling/descriptions.

- Companies must provide comparable GAAP figures, reconciliations, and maintain balance in presentation with non-GAAP equivalents.

- Non-compliance risks consequences and loss of shareholder trust; adherence ensures success and regulatory compliance.

Why the Update is Necessary

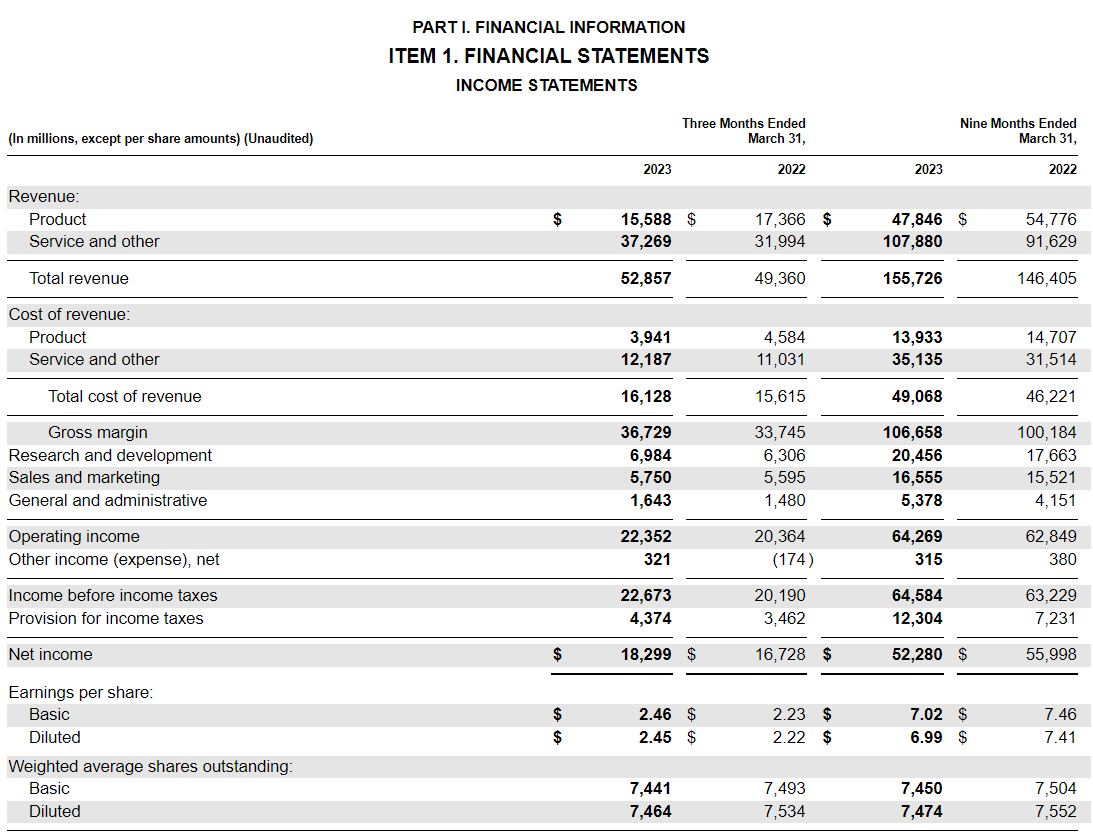

Investors must be able to trust that they’re basing their choices on accurate information, which is why the SEC created Regulation G and Item 10(e) of Regulation S-K as safeguards against potentially deceptive practices involving non-GAAP figures. These regulations require companies using these metrics to provide comparable GAAP numbers alongside them as well as reconciliations for both sets, allowing investors to easily compare them side by side.

Despite this effort, there continues to be cases where corporations employ deceptive tactics through their utilization of non-GAAP measurements. With this new interpretive advice, investors will now have even better assurance that any decisions made based on reported data should not be inaccurate or incomplete.

What the Updated Guidance Covers

The most recent interpretive guidance covers a variety of important topics, ranging from potentially deceptive non-GAAP financial measures to the visibility and accuracy of such metrics in SEC filings.

Use of Potentially Misleading Non-GAAP Financial Measures

The newly clarified guidelines suggest that operating costs which occur periodically, including those that may not be as frequent or regular, should still be deemed recurring expenses. The SEC staff will also analyze each instance on a case-by-case basis, taking into consideration factors like how it affects operations, revenue generation strategies, industry standards, and relevant regulations before coming to a conclusion.

Additionally, Question 100.04 has been expanded upon. Any adjustments made to GAAP principles for recognition or measurement purposes via non-GAAP measurements would constitute an individually tailored adjustment. As a result, it could result in the presentation of inaccurate figures when utilizing these methods and would have to be disclosed or rectified.

The Prominence of Non-GAAP Measures in SEC Filings

The SEC has released updated guidance for companies disclosing non-GAAP measures, emphasizing the importance of equal or greater prominence given to the most directly comparable GAAP measure. Examples of what would be considered an undue emphasis on a non-GAAP measure include presenting only a non-GAAP income statement that includes all line items and subtotals usually found in its corresponding GAAP version. Another common example is omitting any reference to the GAAP figure when reporting earnings releases with headlines or captions containing a single non-GAAP statistic.

Appropriate Labeling and Descriptions of Non-GAAP Measures

The SEC is focused on making sure non-GAAP measures are properly labeled and described in order to avoid any confusion or misleading disclosures. That’s why it’s essential that companies follow Regulation G when referring to a non-GAAP measure, as well as Rule 100(b) of the same regulation for labeling the measure correctly. If you don’t label your measures accurately, you risk violating these rules, which could lead to some serious consequences. This is where working with a professional transfer agent service can be helpful.

What Companies Need To Know

As public companies that make use of non-GAAP measures, it’s essential to consistently review disclosures and ensure they don’t contain any potentially misleading information in light of the new guidance. This includes taking a closer look at what constitutes a recurring expense when excluding certain cash operating expenses for calculating our non-GAAP financials.

Moreover, companies must label and clearly describe each measure appropriately to avoid confusion or misinterpretation from investors. All presentations should be balanced, as GAAP metrics shouldn’t be overlooked in favor of non-GAAP equivalents. Additionally, reconciliations should always start with the most directly comparable GAAP metric first as an added layer of transparency regarding finances.

The SEC is continuing its focus on accuracy within financial reporting with this latest interpretation of using non-GAAP measures. One mistake could lead to significant fines and sanctions. By being vigilant in reviewing these guidelines, it is possible to maintain faith among shareholders while adhering to regulations set forth by the SEC.

Contact Colonial Stock Transfer for Help With Guidance on New Measures

At Colonial Stock Transfer, we understand that paperwork and filing requirements regarding GAAP and non-GAAP requirements can be confusing. Give us a call today to speak to our team, and learn more about how we can help you remain in compliance with these new measures.