What Does a Cap Table Show?

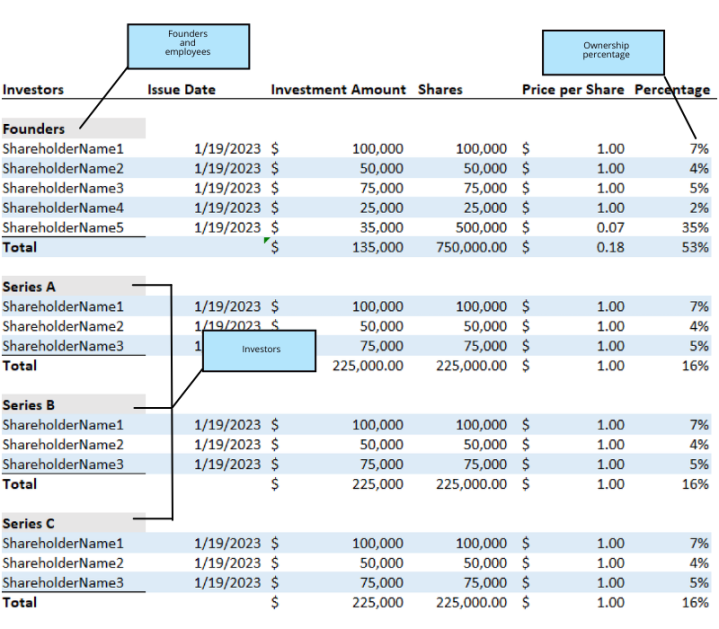

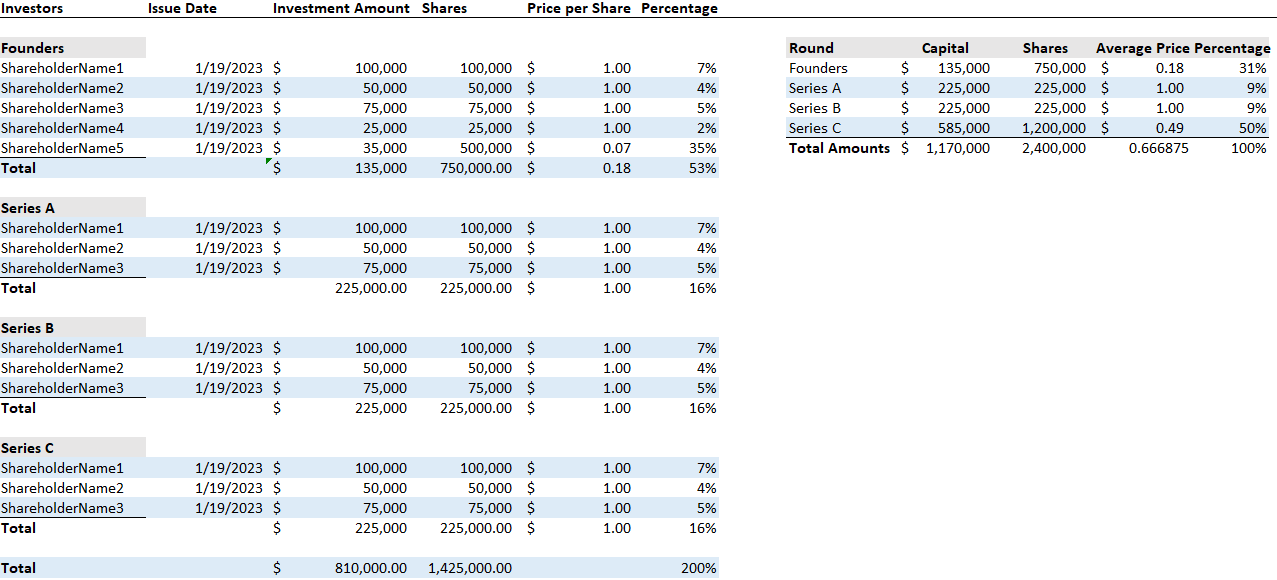

A cap table shows what is known as equity capitalization. Equity capitalization is a breakdown of the ownership structure of a company, showing the different classes of shares that have been issued and how much each shareholder owns. This information is helpful for understanding who has which rights within the company and how they can be affected by decisions such as issuing new stock or raising money.

Why does knowing the equity capitalization of a company matter?

Knowing the equity capitalization of a company is essential for investors and potential investors. It helps them understand what types of shares have been issued, who owns them, and how much each shareholder owns. This information can be used to calculate the ownership percentage that an investor will receive when investing in the company. Furthermore, understanding the ownership structure allows potential investors to assess the risk associated with investing in a company during crowdfunding.

Additionally, founders and other stakeholders of a company need to understand equity capitalization. This will help them make informed decisions about issuing new shares or raising money from outside investors. Knowing the ownership structure and how it is divided up among different shareholders can help protect the interests of all parties involved.

Types of Shares Included in a Cap Table

Equity capitalization typically consists of two different types of shares: common and preferred. They also include warrants and convertible equity.

- Common Shares: Common shares, also known as common stocks, are the most basic form of equity in a company. They represent ownership and can be traded on public markets or given as compensation to employees. Common shareholders usually have voting rights, meaning they can participate in the decision-making process for the company.

- Preferred Shares: Preferred shares represents ownership of a company. Those who have referred shares reserve the right to claim income from the company’s operations. Preferred stockholders also have a leg up on common stockholders, since they can have a higher claim on distributions like dividends.

- Warrants: Warrants allow investors to purchase a certain amount of stock at an agreed-upon price, often at a discounted rate from the current market price. Warrants are usually given to investors as part of an equity financing round.

- Convertible Equity: Convertible equity is a type of security that gives the holder the right to convert it into common shares. It can be issued either as debt or equity and can provide certain financial benefits, such as interest or dividends, to its holders.

In addition to these basic elements, your table could include other items such as:

- Security type (e.g. common stock, preferred stock, warrant)

- The exercise price for warrants

- Voting rights attached to the security

- Liquidation preference/ranking of the security

Having a comprehensive and organized cap table will help investors and stakeholders understand the ownership structure of the company and make informed decisions.

Cap Table Best Practices

There are certain best practices that you should keep in mind when creating a cap table. These include the following tips below.

Use a Spreadsheet Software

Excel is by far the most commonly used software for creating a capitalization table. It is organized, user-friendly, and allows you to input all of the necessary information quickly and accurately. Additionally, Excel has helpful tools such as pivot tables that can be used to analyze the data in your cap table.

Other types of spreadsheet software you can use include Google Sheets, Apple Numbers, and OpenOffice. Even if you’re a small business looking to grow, using spreadsheet software can be an invaluable asset in helping you understand your equity capitalization.

Keep Files Organized

When saving your new Excel sheets and cap tables, it’s important to keep track of any changes, save old versions, and name them properly. This will help you keep track of changes over time and quickly identify the most up-to-date version of your cap table.

Be as Detailed as Possible

Your cap table should include every single security issued by the company, including common stock, preferred stock, warrants, options, and convertible equity. Furthermore, it is important to include the exercise price for warrants, voting rights attached to each security, and liquidation preferences. This information will be essential when understanding the ownership structure of your company.

Organize Your Data Cleanly

When creating a cap table, it is important to organize the data cleanly and clearly. Make sure that each column represents a specific type of information, such as security type or exercise price for warrants. Additionally, make sure that all necessary items are included and that there are no gaps in the data.

Include All Shareholders

Make sure to include all shareholders in your cap table. This includes founders, investors, board members, employees who have been issued stock options or restricted stock units (RSUs), and any other individuals or entities that have a stake in the company. Also, be sure to include information on the vesting schedules and expiration dates of stock options and RSUs.

Review Your Cap Table Regularly

It’s vital to review your cap table regularly in order to stay up-to-date with any changes. This includes any new investors, acquisitions, or dilutions that may have occurred over time. Of course, using a service and cap table software to help you manage your cap table can make this process easier.

Common Cap Table Mistakes

Now that you know how to create a cap table, it’s important to avoid making some of the most common mistakes associated with them.

Not Including All Shareholders

Unfortunately, one of the biggest mistakes smaller startups can make is not including all shareholders in the cap table. This can lead to future issues with equity dilution, disproportionate ownership percentages, and other complications that could cost the company money or time in the long run.

Keep in mind that even minor shareholders play a big role in helping you understand your company’s equity capitalization, so make sure to include them all.

Forgetting to Account for Buybacks

A buyback refers to the company repurchasing its own shares from existing shareholders. This process, also known as a “stock buyback” or “share buyback”, can have a major impact on equity distribution and ownership structure. While buybacks are rare for smaller startups, they can still make a difference.

Therefore, it’s important to account for them in your cap table by adjusting the number of outstanding shares for each shareholder. This will help you stay up-to-date on equity ownership and dilution.

Not Having a Cap Table at All

Some smaller startups may not even have a cap table at all. It’s important to remember that having a comprehensive and well-organized capitalization table can help you manage equity distribution and ownership structure. It also helps investors and stakeholders understand the company’s current position as well as any future changes in ownership.

It’s always best to create a cap table early on in the company’s life cycle and keep it updated as changes occur. Doing so will help you stay organized, make informed decisions, and is a great tool to show potential investors.

How Often to Update Cap Table Reporting

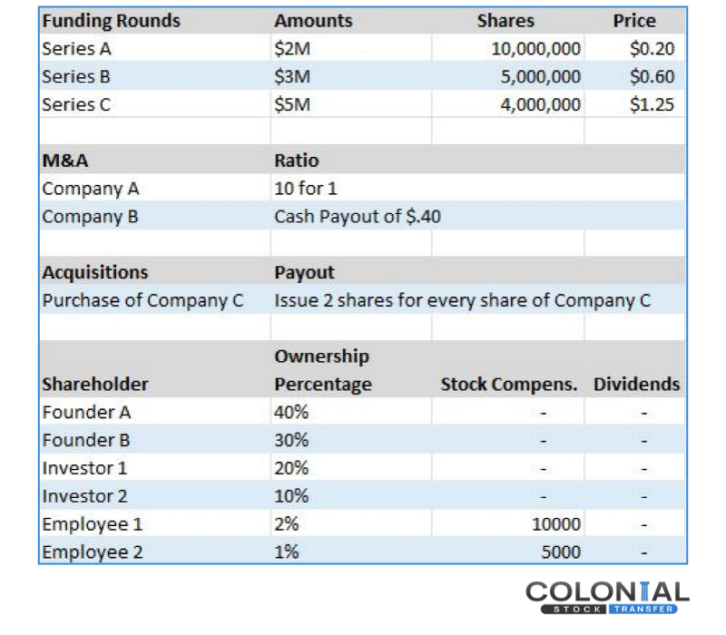

One of the most common questions about cap tables is how often they should be updated. Some of the many financial events that could trigger a change in your cap table include:

- Funding rounds: When your company raises money from investors, the equity ownership structure will change.

- Mergers and acquisitions: Merging with another business or acquiring another company can also have a significant impact on your cap table.

- Issuing new shares: Issuing new shares to employees or founders through stock options or RSUs should be accounted for in the cap table.

- Stock-based compensation: If your company grants equity rewards to employees, these changes should be reflected in the cap table.

- Acquisitions: When your company acquires another business, or if it is newly acquired, make sure to update the cap table.

- Dividends: If your company pays out dividends to shareholders, these should be reflected in the cap table as well.

It’s also important to review and update your cap table any time there is a major change in shareholder status. This could include buybacks, liquidation preferences, or other events that affect ownership structure.

Creating a Cap Table for VC Firms

Shareholder tracking with cap tables is vital for long-standing businesses. However, a cap table for startups is equally as important for those businesses interested in using a VC, or venture capital firm. VC firms offer capital investments to businesses that are in the early stages of growth.

When a business is interested in working with a VC firm, they must provide them with a cap table. This document will give the VC firm a full picture of your company’s current equity structure and financial standing. The cap table should also include information on the vesting schedules associated with employee stock options, as well as exercise prices for warrants and other securities.

By providing a VC firm with a comprehensive cap table, the business can demonstrate that it is organized and prepared to move forward with the investment process. This can help expedite the process and provide assurance to both the startup and the VC firm.

Protecting Investor Interests Through Cap Tables

Ultimately, all stakeholders need to understand the equity capitalization of a company in order to protect their interests. A well-crafted capitalization table can help them do just that. By including key items such as security type, the exercise price for warrants, voting rights attached to the security, and liquidation preference/ranking of the security, you can ensure that everyone involved clearly understands the company’s equity capitalization.

A stock transfer agency like Colonial Stock Transfer can help keep your cap table up-to-date, as well as serve as a third-party custodian for all shareholder records and documents. This helps ensure the accuracy of the data and protects investor interests by proactively managing any changes.